Japan's mobile gaming-dominated video games market has consistently seen a rapidly growing PC segment. Based on recent findings by industry analysts, PC gaming has “tripled” in size in Japan in just a few years.

Japan's PC Gaming Scene “Triples in Size” After Consistent Growth

PC Gaming Makes Up 13% of Japan's Overall Gaming Market

Over the recent years, Japan's PC Gaming market size has seen consistent growth, with reported year-on-year increases of the segment's revenue. As concluded by industry analyst Dr. Serkan Toto, Japan’s PC Gaming market size has "tripled" over the past four years, based on data shared by Japan’s Computer Entertainment Supplier’s Association (CESA). Leading up to last week's Tokyo Game Show 2024 showcase, CESA revealed that Japan’s PC gaming market reached $1.6 billion USD, approximately 234.486 billion Yen, in 2023.

Though its growth from 2022 only incrementally increased by approximately $300 million USD, the consistent boom has led the PC gaming market segment to make up 13% of the size of a mobile-dominated Japanese gaming market. Though the numbers "may sound low in dollar terms," as Dr. Sekan Toto notes, "the Japanese yen has been extremely weak over the last years and still is," meaning players could be spending more in terms of the country's currency.

Japan's gaming market predominantly influenced by mobile gaming, which dwarves the PC segment's size based on further data shared by industry analysts. To put into context, Japan’s mobile gaming market—including online sales such as microtransactions—grew to $12 billion USD, approximately 1.76 trillion Yen, in 2022. "Smartphones remain Japan’s biggest gaming platform," Dr. Sekan Toto iterated in a report. For further context, Japan's "anime mobile games" market accounts for 50% of the global revenue, according to Sensor Tower's "2024 Japan Mobile Gaming Market Insights" report.

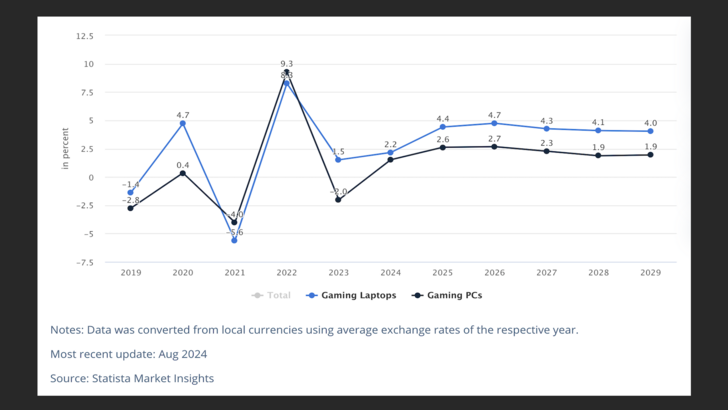

- (c) Statista

Industry analysts are of the opinion that the significant growth in the "Gaming PCs & Laptops market" in Japan can be attributed to "customer preferences for high-performance gaming equipment and the increasing popularity of esports." An aggregate report by Statista Market Insights showed that Japan might expect revenue for its PC gaming market to boom to 3.14 billion Euro this year, approximately 3.467 billion USD. "Within the Gaming PCs & Laptops market market, the number of users is expected to reach 4.6m users by 2029," as noted in the company's data insights.

"Japan actually has a rich history of early PC games that started on home-grown computers around the early 1980s," remarked Dr. Sekan Toto in one of his studies. "It is correct that soon after, consoles and later smartphones took over, but PC gaming was really never dead in Japan and its niche character has always been a bit exaggerated in my view." Among the factors he cited that behind Japan's PC Gaming boom are the following:

⚫︎ Rare but existing home-grown PC-first hits like Final Fantasy 14 or Kantai Collection

⚫︎ Steam has a drastically improved store front for the Japanese audience and expanded its presence

⚫︎ Smartphone hits are increasingly present on the PC as well, in some cases on day one

⚫︎ Improved local PC gaming platforms; as well as Steam's expanded presence and improved store front for the Japanese audience

Xbox, Square Enix, and Other Gaming Giants Expand PC Segment

Popular games that continue to dominate Japan typically are associated with the eSports scene, which likewise has seen increasing popularity in the country over the recent years. These games include StarCraft II, Dota 2, Rocket League, and League of Legends. The recent years have also seen influential game developers and publishers bringing their games over to the PC platform, catapulting a renewed focus on targeting Japanese PC Gamers.

One such example would be Square Enix bringing Final Fantasy 16 to PC earlier in the year. The gaming giant has also affirmed its plans of adapting a two-prong approach of releasing games on both the console and PC.

Meanwhile, Microsoft, with its gaming arms of the Xbox console and PC, continue to expand their presence in Japan's gaming market. Xbox executives Phil Spencer and Sarah Bond have actively promoted and expanded Xbox and Microsoft Gaming in the country, securing support from major publishers such as Square Enix, Sega, and Capcom, with Xbox Game Pass cited as a main driver for securing its partnerships.

Source:

Japan’s PC Gaming Market Size Triples In 4 Years

Japan’s Gaming Market Slightly Grew in 2022 – Against The Global Trend

Japan’s PC Gaming Market Doubles In Size In 3 Years

Japan’s Mobile Gaming Market Grows To US$12 Billion

Market Insight: Gaming PCs & Laptops - Japan

2024 Japan Mobile Gaming Market Insights

The Most Played Games in Japan 2023