Nintendo and Sony, two of Japan's largest names in the gaming business, see their stocks experience a significant decline coming in 2024. Read on to learn more about the situation and the overall climate of their businesses.

Nintendo Shares Dip by 8.8% in a Single Day

Delay of a Switch Successor Cited as the Most Considered Facet

Nintendo's market shares experienced a significant decline in Tokyo trading after reports surfaced regarding the delay in the launch of the company's anticipated Switch successor. Shares plummeted by as much as 8.8% on Monday, as reported by Bloomberg, marking the largest intraday shares decline—occurring within a single day—Nintendo has seen since October 2021.

The news came as Nintendo informed its publishing partners about the delay of its next game console's release to early 2025. Some partners were cautioned not to anticipate the launch until March 2025 at the earliest, according to Bloomberg. In Nintendo's recent financial results briefing that took place earlier this month, Nintendo President Shuntaro Furukawa declined to comment on a Switch successor beyond saying that Nintendo is always researching new hardware and software.

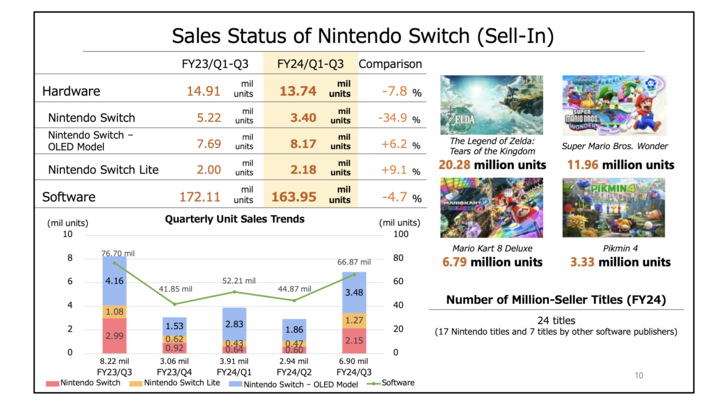

Furukawa addressed the business challenges associated with the generational transition of gaming console platforms. "Unit sales of Nintendo Switch hardware and software both decreased year-on-year," Nintendo noted in its financial report.

Mio Kato, from LightStream Research, suggested that newer investors may be less patient with Nintendo's progress, potentially impacting the company's fiscal performance for the March 2025 fiscal year. Robin Zhu, an analyst at Bernstein, anticipated an announcement regarding the new hardware within the next six months. Despite the setback, some analysts view the decline in Nintendo's stock as a buying opportunity.

Shares Will Continue to Plummet if Software Also Lags Behind

Image from Nintendo

Image from Nintendo

Serkan Toto, a Tokyo-based video game consultant, highlighted the significance of software to Nintendo's revenue stream. Software currently accounts for 163.9M unit sales—a far cry from Hardware sales totaling 13.74M units. However, the company is unlikely to launch new installments in major franchises like Legend of Zelda and Mario before the release of the new console.

Sony's Stock Value by $10 Billion

Operating Margin Worries Investors

Sony faced a $10 billion loss in market value following a revision in sales forecast for the PS5 console. The company revised its sales projection for this fiscal year ending in March, lowering it to 21 million units from the initial target of 25 million units.

The downward revision in sales forecasts led to a significant drop in Sony's share price, according to CNBC reports. Analysts expressed concerns not only about the revised sales forecast but also about the declining operating margins* in Sony's gaming business.

- As defined, operating margin is the company's revenue minus the cost of goods sold and operating expenses, which typically include selling, general, and administrative costs; sales and marketing; research and development; and depreciation and amortization.

Atul Goyal, an equity analyst at Jefferies, highlighted investors' disappointment regarding Sony's operating margin in the gaming division, which fell to nearly 6% for the December quarter. This decline was described to be severe compared to the over 9% margin recorded in Sony's 2022 December quarter.

Serkan Toto, CEO and founder of Tokyo-based games consultancy Kantan Games, attributed the declining margins to rising production costs of software, with high budget games like Spider-Man 2 that recently also confirmed a huge update coming in early this year.

Despite record-high revenue from digital sales and its subscription services like PS Plus, Sony's gaming margin remains at a decade low. The disparity between the two financial factors raised concerns about the company's profitability in the gaming segment, especially amid the challenging market conditions. Last year, Sony bumped up the prices for PS Plus to keep up with market conditions.

Nintendo and Sony's Market Cap Overview

While Nintendo's stock faced a setback, the company continues to rank as the wealthiest in Japan, boasting over $11 billion in cash reserves. On the other hand, Sony faces challenges in maintaining its gaming margins amidst rising software production costs, leading to concerns among investors.

In terms of market capitalization*, Sony ranks higher globally, ranking at #133 compared to Nintendo's #269 position. However, Sony's latest financial reports revealed a total debt of $31.33 billion as of September 2023, while Nintendo's debt-free status perseveres to 2024.

- As defined, market capitalization refers to how much a company is worth as determined by the stock market.

Source:

Bloomberg: Nintendo Sinks After Game Makers Say Switch 2 Pushed to 2025

CNBC: Sony plunged $10 billion after its PS5 sales cut. But a bigger issue is its near decade low games margin

Tokyo Keizai: 上位2社は1兆円超「金持ち企業」ランキング300社

Companies Market Cap: Nintendo profile

Companies Market Cap: Sony profile

The Motley Fool Finance